lhdn income tax rate

Latest income tax notice of assessment or latest 6 months CPF Contribution history statement. Payment of increase of tax if any should be paid separately using Form CP147 and separate cheque.

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Individual Income Tax Return Frequently Asked Questions for more information.

. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam. 109B2 of the Income Tax Act 1967. Sections 107A 1a and 107A 1b 10 3.

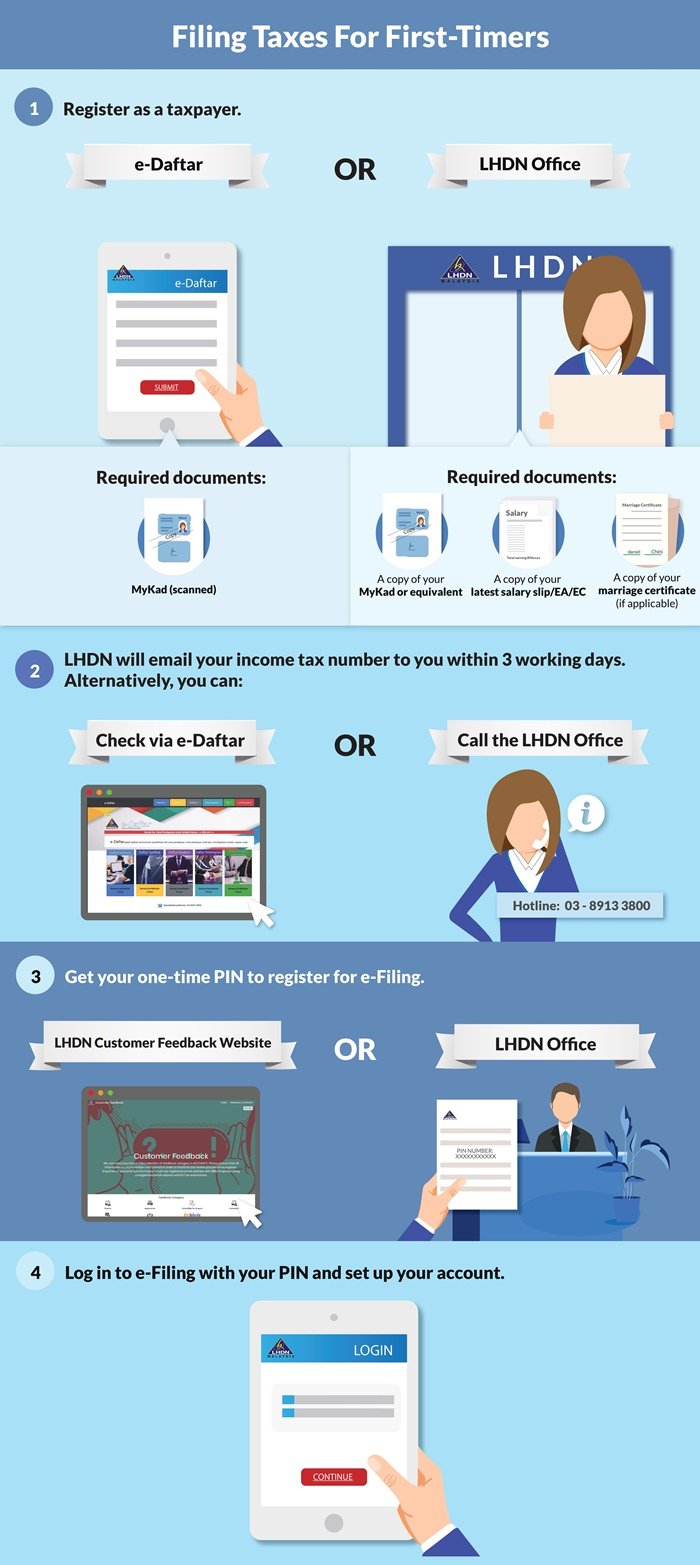

Claiming these incentives can help you lower your tax rate and pay less in overall taxes. 3 months payslips 3 bank statement if required OR. Guide To Using LHDN e-Filing To File Your Income Tax.

Alamat Pos Postal Address Kaunter Bayaran Payment Counter SEMENANJUNG MALAYSIA Kompleks Pejabat Kerajaan PENINSULAR MALAYSIA Jalan Duta Lembaga Hasil Dalam Negeri Malaysia Cawangan Pungutan Tingkat 15 Blok 8A. How To Pay Your Income Tax In Malaysia. See Form 1040-X Amended US.

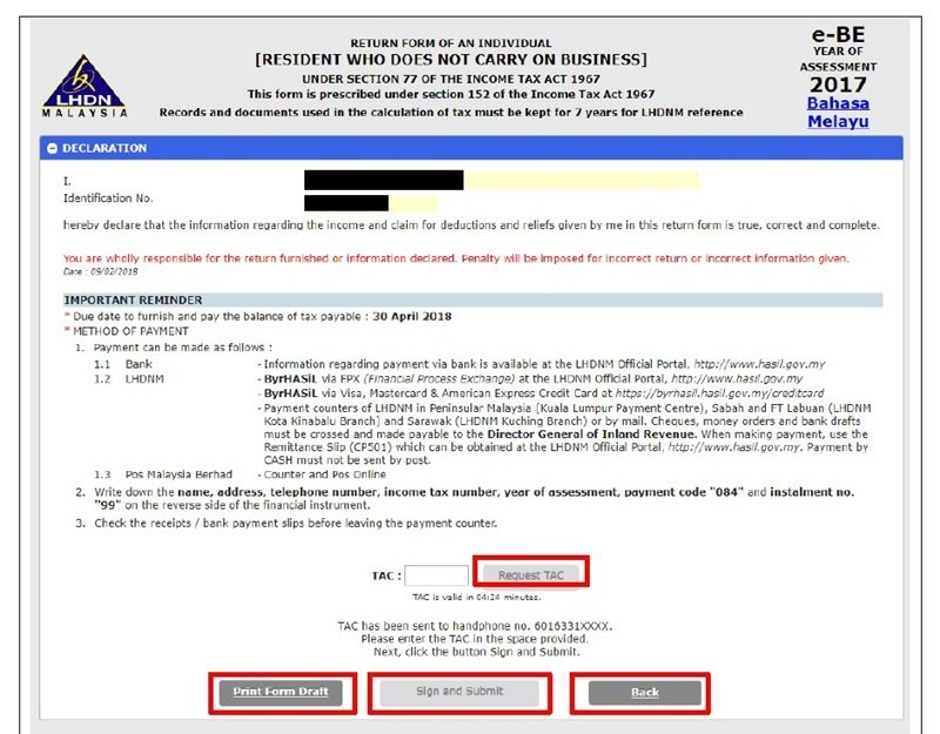

While explained in detail under Section 4d of the Income Tax Act 1967 the summary of it as according to LHDN is The letting of real property is treated as a non-business source and income received from it is charged to tax under paragraph 4d of the Income Tax Act 1967 if a person lets out the real property without providing maintenance. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable. Guide To Using LHDN e-Filing To File Your Income Tax.

Income Tax Act 1967 Withholding Tax Rate Payment Form. The ICU utilisation rate nationwide stood at 639 with nine states or localities recording ICU usage rates of more than 60. How To File Your Taxes Manually In Malaysia.

You still have the option to. You can file Form 1040-X Amended US. On the First 20000 Next 15000.

Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. According to the statement of claim LHDN said Nooryana Najwa failed to submit the Individual Income Tax Return Forms to the IRB under Section 77 of the Income Tax Act 1967 for the years of. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. 6 months payslips commission statement OR. Copy of NRIC front and back AND.

Find Out Which Taxable Income Band You Are In. In 2020 two separate High Courts allowed LHDNs applications to enter a summary judgment to recover tax arrears of RM169bil from Najib and RM376mil from Nazifuddin for the period between 2011. However if the company has failed to obtain one the worker can register for an income tax number at the nearest IRB office.

EPF Rate variation introduced. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. How Does Monthly Tax Deduction Work In Malaysia.

On the First 5000 Next 15000. The Inland Revenue Board of Malaysia LHDN says that effective Aug 1 2022 recurrent small-value withholding tax WHT payment for royalty interest and special classes of income. Copy of NRIC front and back AND.

Find Out Which Taxable Income Band You Are In. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL.

Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. 3 months payslips 3 bank statement if required OR. Tax Offences And Penalties In Malaysia.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. LHDN withdraws income tax appeal against Najibs daughter Toddler. How To Pay Your Income Tax In Malaysia.

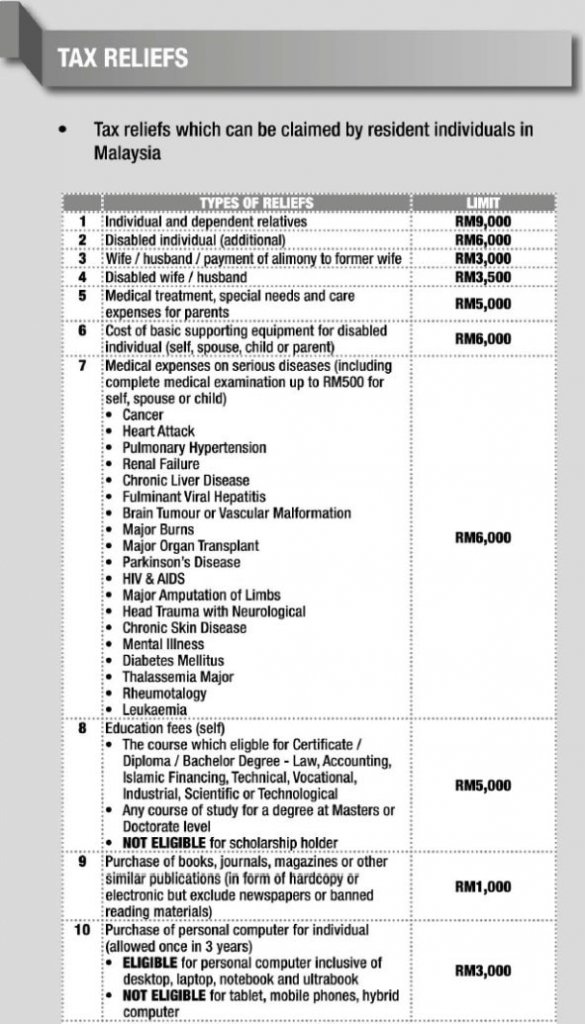

With that heres LHDNs full list of tax reliefs for YA 2021. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

On the First 5000. As per LHDN the income of a non-resident from the following special classes of income is subjected to tax in Malaysia if it is derived from Malaysia. According to the statement of claim LHDN alleged that Nooryana Najwa failed to submit the Individual Income Tax Return Forms to the IRB under Section 77 of the Income Tax Act 1967 for the years.

Resetting number of children to 0 upon changing from married to single status. Borang BBE with LHDN Acknowledgement Receipt. Guide To Using LHDN e-Filing To File Your Income Tax.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Calculations RM Rate TaxRM A. Heres How A Tax Rebate Can Help You Reduce Your.

Self parents and spouse 1. How To File Your Taxes Manually In Malaysia. Chargeable Income RM Annual Calculations RM Rate Tax RM A.

Salaried Employment in Singapore Fixed and Commission Earner. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

Borang BE with LHDN Acknowledgement Receipt. Latest income tax notice of assessment or latest 6 months CPF Contribution history statement. 6 months payslips commission statement OR.

For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of your aggregate income to reduce your chargeable income. On the First 5000 Next 15000. Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form.

According to LHDN Income Tax Rates page the chargeable income tax in Malaysia for Year Assessment 2021 follows the following table. Normally companies will obtain the income tax numbers for their foreign workers. Tax Offences And Penalties In Malaysia.

Salaried Employment in Singapore Fixed and Commission Earner. On the First 5000. Income tax filing for sole proprietors is straightforward.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Explanatory Notes Lembaga Hasil Dalam Negeri

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Personal Tax Relief For 2022 Smart Investor Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Details Of 2 Agent Commission Withholding Tax L Co

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Says The Caption Here Does Not Have The Full Information For The Full Guide Visit Bit Ly Incometax2022 The Table Of The Income Tax Bracket Found On The Lhdn Website Facebook

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

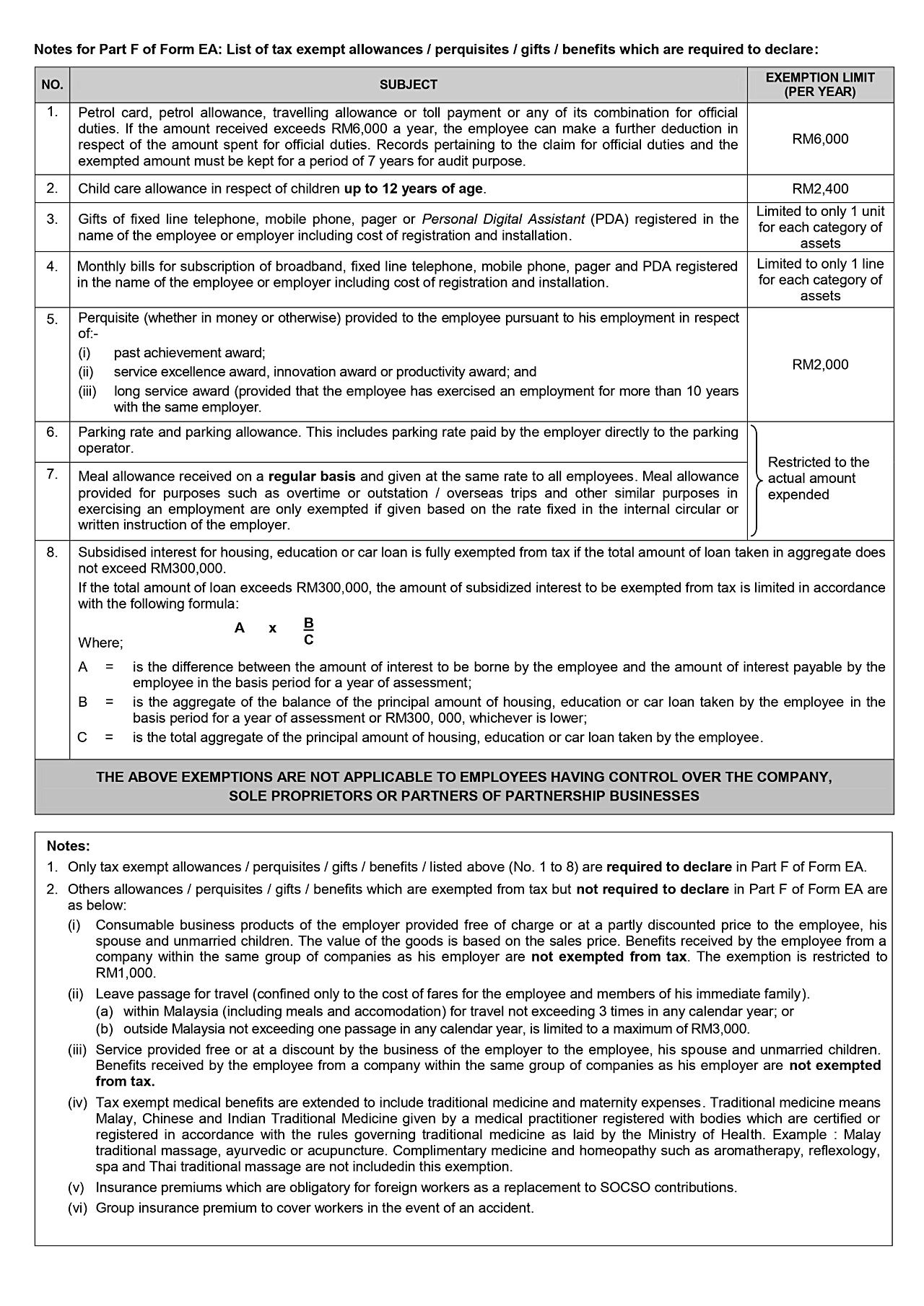

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Malaysia Personal Income Tax Guide 2022 Ya 2021

Comments

Post a Comment